Rates Higher for Longer

Rates Higher for Longer

John Lekas – CEO and Senior Portfolio Manager

November 23, 2022

Interest rates will be higher for longer in our view and conversely, the market will be in the doldrums for longer. “Do not fight the Fed”. We expect rates to stay higher for longer; the Federal Reserve most likely pauses between 5.25 and 6 % in 2023. We believe the Fed will raise 0.5 – 0.75 at the next meeting on December 14th, 2022, resulting in another leg down in the equity markets and another bludgeoning to emerging markets.

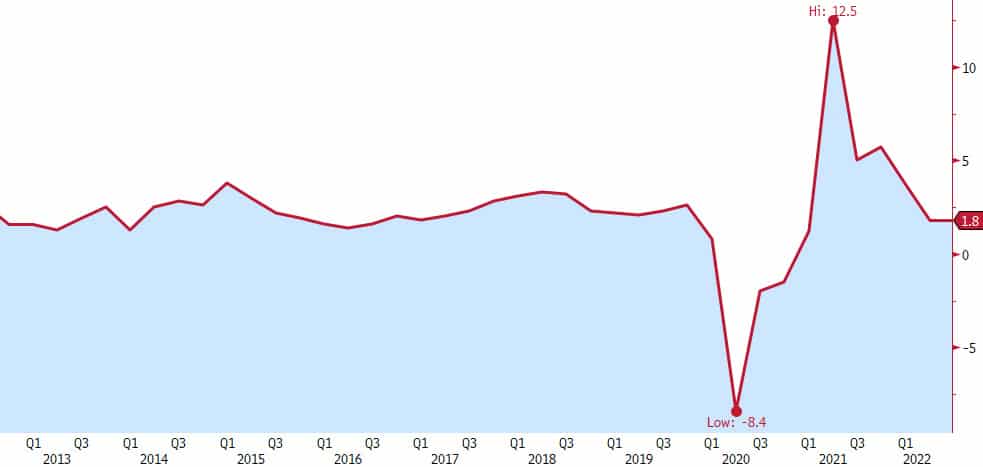

We agree with Stanley Druckenmiller* that equity markets could be flat to lower for the next decade. The Fed is focusing on CPI rather than commodities or GDP deflator. CPI is end user prices, which will continue to rise, causing wages to rise as well. It is the rising wages that will keep inflation embedded in the system for some time. In our opinion, people are not returning to work but staying home, resulting in 20 to 30 % less productivity keeping the supply chain tight, and GDP declining. So, you get the worst of both worlds, higher costs, and less productivity.

US CPI Urban Consumers YoY

GDP US Chained YoY

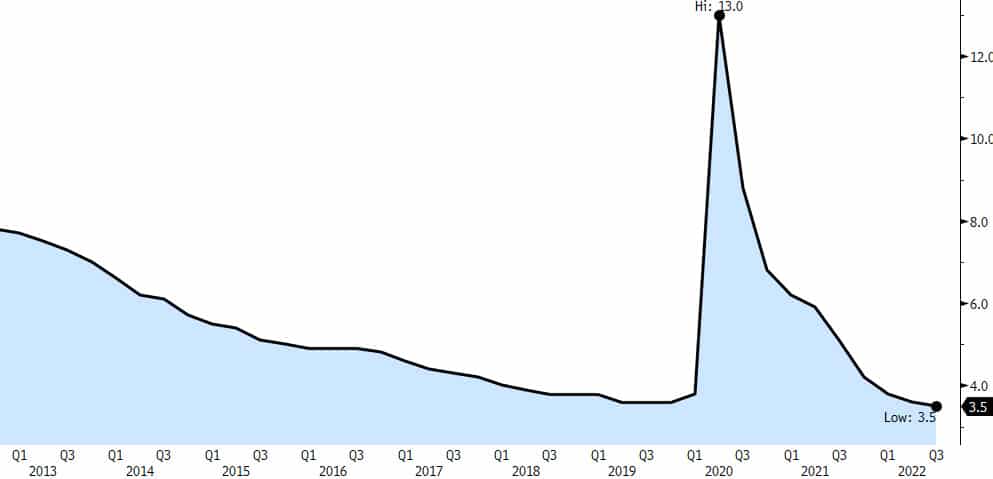

As we said in our previous newsletter (Unemployment, Fed & the War), this will cause unemployment to rise as companies lay off people to make their numbers and remain profitable; unemployment is 75% negatively correlated to equity markets. In simple terms, if U-3 rises, equity markets go lower. And why not, if I can earn 6 – 7 % in credits; why bother with equities? The crypto disaster puts an exclamation point on this theme. Even if the federal reserve pauses, they are not going to lower. Europe and China are also raising rates, and the momentum will be higher and with us for some time. It is a conundrum to have rising wages and higher unemployment, but here we are.

U-3 US Unemployment Rate Total in Labor

Risk assets should be poor parking spots in the near future. The sweet spot will be on the short end of the curve in high-quality low duration products. The long end of the curve will make for suitable trading but higher risk as the curve inverts. The yellow brick road will be hard to find until inflation settles down.

Our High-Quality Floating Rate Fund will manage and has managed quite well through the turbulence as things reset. We will remain in quality assets and stay short in duration for the foreseeable future. This is the first time in almost 14 years that investors can earn over 4% in close-to-riskless assets. “Don’t look a gift horse in the mouth.”

*Legendary investor Stanley Druckenmiller warning

This commentary is intended to be general in nature, reflects our opinions and is based on our best judgment at the time of writing. No warranties are given or implied regarding future market activity. This commentary is not intended to be, nor should it be used as a substitute for individualized investment advice. No specific decisions should be made based on this commentary. These opinions should not be construed as a solicitation for any service. Past performance does not guarantee future results