Perfect Storm

John Lekas – CEO and Senior Portfolio Manager

May 1st, 2023

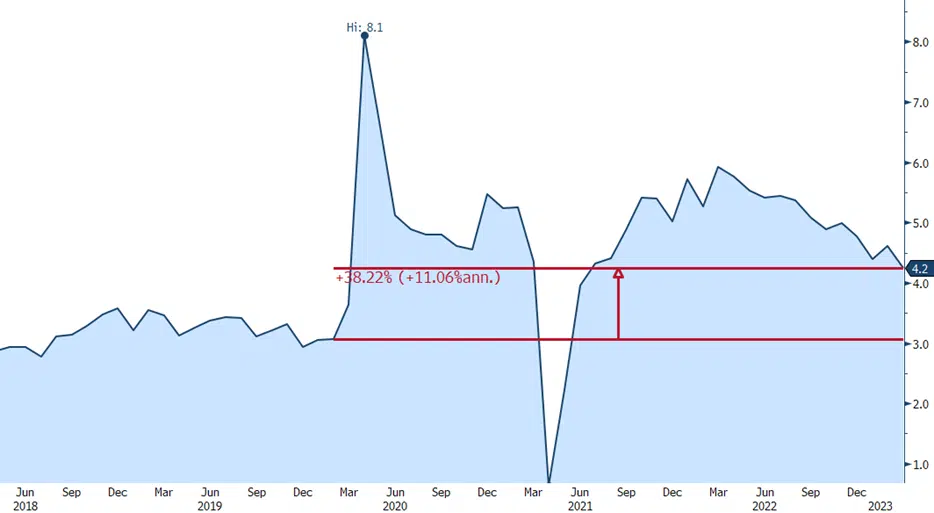

US Average Hourly Earnings Yearly Percent Change

We believe the inflation we are seeing in the CPI and elsewhere will persist well into 2024. As we have stated in the past, this inflation is due to high wages, not the cost of goods sold. Wages have surged 38%* on average since 2020, compared to the typical annual increase of 3.66%, making it difficult to reduce without terminating staff; and until the U-3 and U-6 unemployment rates reach 5 or 6%, we believe inflation (as measured by the GDP deflator and CPI) will not subside. In a nutshell, everyone is looking at the wrong number. The number to watch is unemployment. (U3+U6)

An increase in unemployment from 3.5% to 6% could result in a steep decline in equity markets, necessitating a focus on quality assets in both equity and fixed-income environments.

Secondly, the banking sector has not yet resolved its issues, with mergers and failures anticipated in the coming year. We believe the next shoe to drop will be real estate as the FDIC gets aggressive with regional banks because of the recent bank failures. There is $1.5 trillion of real estate debt due by 2025. Regionals have the bulk of this debt**.

Thirdly, we believe sanctions that were put in place because of the war in Ukraine have hurt the USA, gummed up liquidity, and may have begun to displace the dollar as the world’s reserve currency. The current administration is too blind to recognize or admit a failure and get off it (the current banking crisis is one example). As they continue to blunder, look for more politicization, and not real fixes as we move forward (debt ceiling, reparations, windmills, balloons, failing to increase FDIC insurance, etc.) policy is random and will hurt the financial system.

We are beginning to see layoffs from large corporations and look for more. Initially, this is good news, but as we move forward, look for markets to contract rather than expand.

Three main risks are associated with fixed income; liquidity poses the greatest threat, followed by credit, with duration being the least. Quality provides a higher level of liquidity and safety. We continue raising cash, keeping quality high, and looking for opportunities as markets move lower.

Leader High Quality Floating Rate Fund (LCTIX)

LCTIX Stats as of 3/31/2023

- Five-star fund

- Duration: 0.24

- Distribution Yield: 6.61%

- Average Credit Quality: A+

*Bloomberg

**A $1.5 Trillion Wall of Debt Is Looming for US Commercial Properties (yahoo.com)

For Financial Professional Use Only – Email not for Public Distribution

Investing in any mutual fund involves risk, including loss of principal. The risks specific to the Leader Funds are listed on the attached Fact sheets and detailed in the prospectuses for the funds. There is no guarantee the funds will achieve their objectives. Expense ratios are as of the 10/1/2022 Prospectus.

An investor should consider the Fund’s objectives, risks, charges, and expenses carefully before investing or sending money. This and other important information can be found in each Fund’s prospectus. For more information, please call please read the prospectus carefully before investing.

Current Yield is the weighted average of the annual rate of return based on price. It is calculated by the coupon divided by the price. Average Yield-to-Maturity is the weighted average of the percentage rate of return if the security is held to maturity.

Leader Capital Corp. serves as adviser to Leader Short Term High Yield Bond Fund, and Leader High Quality Floating Rate Fund, distributed by Vigilant Distributions, Inc., Member FINRA/SIPC. Leader Capital and Vigilant are not affiliated.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Share prices and investment returns fluctuate and investor shares may be worth more or less than the original cost upon redemption. To obtain performance as of the most recent month-end, please call