Next Dose of Inflation

John Lekas – CEO and Senior Portfolio Manager

July 24th, 2023

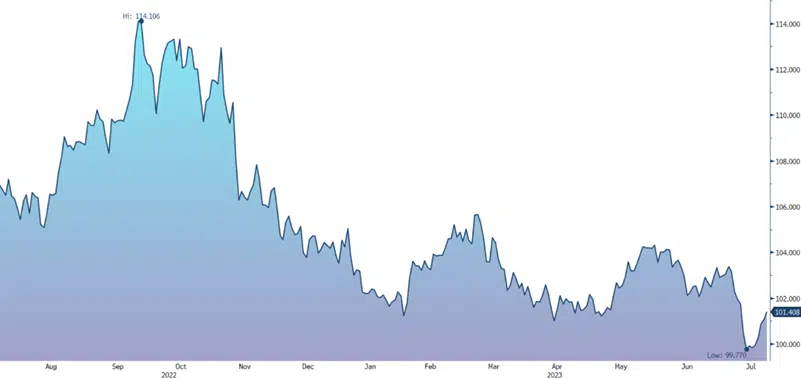

We anticipate that weakness in the US dollar (DXY) will initiate an upward trajectory in commodity prices. The sanctions against Russia have led to fragmented financial markets, allowing movement away from the dollar towards other currencies for the purpose of trading commodities; currencies such as the Chinese renminbi, the Indian rupee, the ruble, and the euro. As a result, foreigners have been selling dollars as they are not needed for all their raw material purchases, and owning dollars has been proven to be a losing proposition. For the Federal Reserve to have raised 6 times since September 2022 and have the dollar down 12% is indicative of a currency that wants to go lower; the dollar should’ve rallied on the interest rate hikes.

US Dollar Index Spot Rate

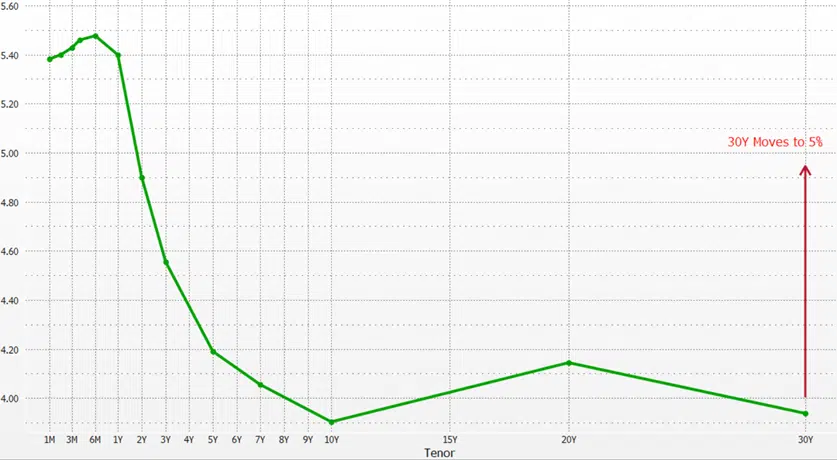

Currently, the US treasury debt is at $32 trillion (±), and interest payments on this debt have gone from $160 billion annually to approximately $1.4 trillion annually on a go-forward basis. Total tax revenues for 2023 are estimated at around $2.4 trillion, and military spending is at approximately $800 billion; there remains limited funding for other essential services. Our projection suggests that the total debt will escalate by an additional $2 trillion, reaching approximately $34 trillion in 2024, further diluting the dollar. We are now in a position where the United States cannot pay the money back. Traditionally, this dilemma is tackled by devaluing the currency and settling debts with depreciated dollars. If the Federal Reserve lowers rates, the dollar could go into a free fall, rattling markets and driving food and energy to much higher levels. Apples at $6.00 per pound and gasoline at $7.00 per gallon is a real possibility. It is likely that the Federal Reserve will persist in raising interest rates, despite the relatively low impact thus far. Furthermore, as the economy continues to thrive and the risk of a recession diminishes, the yield curve should begin to normalize.

US Treasury Curve Prediction

In this scenario, extending maturities may prove to be painful. We believe it is prudent to adopt a risk/reward approach by maintaining shorter maturities. We expect the Federal Reserve will raise rates by another 0.25 at the forthcoming meeting on 7-26-23 and come with additional hawkish comments.

For Financial Professional Use Only – Email not for Public Distribution

Investing in any mutual fund involves risk, including loss of principal. The risks specific to the Leader Funds are listed on the attached Fact sheets and detailed in the prospectuses for the funds. There is no guarantee the funds will achieve their objectives. Expense ratios are as of the 10/1/2022 Prospectus.

An investor should consider the Fund’s objectives, risks, charges, and expenses carefully before investing or sending money. This and other important information can be found in each Fund’s prospectus. For more information, please call please read the prospectus carefully before investing.

Current Yield is the weighted average of the annual rate of return based on price. It is calculated by the coupon divided by the price. Average Yield-to-Maturity is the weighted average of the percentage rate of return if the security is held to maturity.

Leader Capital Corp. serves as adviser to Leader Short Term High Yield Bond Fund, and Leader High Quality Floating Rate Fund, distributed by Vigilant Distributions, Inc., Member FINRA/SIPC. Leader Capital and Vigilant are not affiliated.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Share prices and investment returns fluctuate and investor shares may be worth more or less than the original cost upon redemption. To obtain performance as of the most recent month-end, please call 800-269-8810