How Bond Funds Have Fared During the Fed’s Rate Hikes

When it came to helping investors navigate recent debt-market turmoil induced by Federal Reserve rate increases, bond-picking fund managers largely came up short.

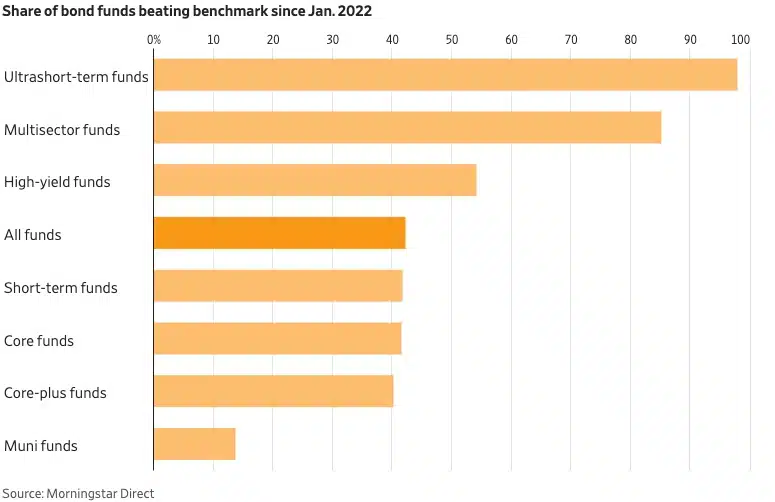

Of almost 2,000 actively managed bond funds covering a range of investing strategies, 58% failed to beat comparable bond indexes after accounting for the fees that investors pay over the last 18 months—roughly the stretch of the Fed’s campaign—according to data from Morningstar Direct. With bond prices suffering across the board, only about one in 10 of the funds posted positive returns.

Most bond-index funds also lost money over that stretch. But many eked out a slightly better performance than active managers, in part because they cost less.

Passive index funds have posed stiff competition for active investing strategies for decades. Firms like Vanguard and BlackRock’s iShares unit have popularized the idea that owning a broad basket of securities is cheaper and no less lucrative than carefully curating a portfolio. But even some investors who have been sold on passive stock strategies still stand by active bond management, arguing that the quirks and complexities of debt investing mean their market is different.

Indeed, heading into 2022, active bond-fund managers had performed much better. An analysis by Fidelity Investments found that over the one-, three-, five- and 10-year periods through 2021, between 60% and 91% of active bond managers beat their benchmarks in strategies spanning short-term bonds, investment-grade funds and multisector approaches.

Then the Fed embarked on its most aggressive rate-hiking campaign since the 1980s. As interest rates rose from near-zero levels to more than 5%, the value of bonds outstanding plummeted in the worst year for debt markets in recent memory.

Periods of fast-changing rates can be some of the most challenging conditions for bond managers, said Roger Aliaga-Diaz, head of portfolio construction at Vanguard Group, which offers both active and passive funds. “Of all the aspects of active management, forecasting interest rates is probably the most difficult,” Aliaga-Diaz said.

Fixed-income managers’ struggles spanned a broad range of bond categories. Only 14% of 102 intermediate-term municipal-bond funds beat Morningstar’s benchmark. Of 169 funds that buy a blend of high-quality and junk-rated debt, 40% fared stronger than the index. A majority of junk-focused managers eked out an above-benchmark showing, but 46% still lagged behind the benchmark.

Coming into 2022, fund teams found it challenging to guess how fast rates were about to climb, said George Truppi, a co-portfolio manager for Greenspring Funds’ Income Opportunities Fund. As yields started to tick up, many were baited into pulling the trigger on buying medium-term bonds, only to watch values sink as persisting inflation fueled a further stream of Fed rate increases, he said. The longer until a bond’s maturity, the more its price falls when rates rise.

Greenspring’s fund, founded in late 2021, protected against that risk by choosing inexpensive bonds that Truppi’s team believed would soon be paid off early by corporate borrowers. This year, for instance, the group made a quick profit when it correctly forecast that one borrower, road-salt maker Compass Minerals International, would repay its discounted junk-rated debt a year early.

Moves like that helped Greenspring effectively limit the fund’s duration, a Wall Street measure of its sensitivity to changes in rates. The strategy helped the fund achieve a 2.7% return between January 2022 and June 2023, one of the best results of the junk-bond funds Morningstar tracked.

Other top-performing funds found their own ways to limit the pain from rising interest rates.

As 2022 began, John Lekas, chief executive of Leader Capital in Vancouver, Wash., pushed more of his investment-grade fund’s money into bonds with floating interest rates. Because the yield on these bonds—largely issued by banks—rose alongside the Fed’s target rate, prices fell less than those of ordinary corporate bonds, which have fixed coupons.

The move cut the fund’s duration—expressed as a weighted average of how long it will take to receive all of the bonds’ payouts—from more than four years in 2021 to less than a quarter of a year today, helping absorb the blow that struck most peers. The fund’s 7.4% return since the start of 2022 made it by far the best performer in Morningstar’s core-plus category.

“When the Fed in 2021 started talking about transitory inflation, we didn’t believe that,” Lekas said. “Inflation is a hard bug to kill and it always has been.”

Strategies with little exposure to rising interest rates did the best. Loan funds, which mostly buy floating-rate debt, returned 3.3%, and funds that focus on ultrashort-term debt returned 2.4%. Two funds specifically designed to achieve outsize benefits when rates rise, the Simplify Interest Rate Hedge ETF and the FolioBeyond Alternative Income and Interest Rate Hedge ETF, were the best performers that Morningstar tracked, returning 73% and 40%, respectively.

Funds specifically focused on long-term bonds and lower-yielding government debt—those with the most to lose when rates rise—were the biggest decliners. The Pimco Extended Duration Fund lost 36%, and the Vanguard Long Term Treasury Fund fell 27%.

Passive funds typically mean significantly cheaper fees. The active fund that Truppi helps oversee at Greenspring charges investors about 0.9% of their invested capital a year. A typical junk-bond index fund offered by BlackRock’s iShares unit charges 0.5%.

Even though most bond managers underperformed during the Fed’s rate increases, few turned in results that dramatically differed from the benchmark. Morningstar’s benchmark for core funds, which buy Treasury debt and other investment-grade bonds, lost 11.2% over the last 18 months. Of the 125 active core funds that Morningstar tracked, 95 offered returns that came within 2 percentage points.

Shawn Gibson, chief investment officer at Atlanta-based Overlay Shares, said that his firm’s active funds don’t try to outsmart benchmark indexes. Instead, they use an options strategy to nudge returns slightly closer to those available on stocks—a feature that meant Overlay’s core bond fund lagged behind the index over the last 18 months.

“It’s very, very difficult to do better than the index through active management on a consistent basis,” Gibson said.

Appeared in the July 31, 2023, print edition as ‘Bond Funds Stumbled During Fed’s Rate Increases’.

Source: The Wall Street Journal