Contractors Are Calling

John Lekas – CEO & Senior Portfolio Manager

November 2nd, 2023

I’ve had a rather eventful week, receiving four calls from contractors offering a range of services. The list included remodeling the lower bathroom shower, treating my shake roof, gardeners proposing budget-friendly rates, and even someone offering to resurface my driveway. It’s worth noting that we already undertook a remodeling project last January, but this all came in a week’s time. Eight months ago, contractors were four months out to complete work. Now, contractors are looking for work and are one week out.

On a broader economic note, despite the advancements in high-tech, over 240,000 individuals have been laid off this year in the high-tech sector, marking the highest annual layoff figure on record*. The U-3 unemployment rate might look relatively low, but it’s essential to acknowledge that the government’s job-counting methods can be somewhat deceptive. The U-6 unemployment rate may offer a more comprehensive perspective, as it includes part-time and full-time, but the calculations are complicated. It’s increasingly evident that the economy is slowing down, and the emerging data strongly suggests that we may be on the brink of a significant recession.

Turning our attention to commodity prices in 2023, some key elements are worth noting, such as the prices of steel, oil, aluminum, wheat, and lumber are all down for the year. In a global context, Europe, China, and India are struggling to stimulate their economies. China’s economic situation is notably the most challenging, and it happens to be the United States’ biggest trading partner.

Commodity Prices Drop in 2023

| Commodity | High Price | Current Price as of 11.2.23 |

|---|---|---|

| Steel | $1,200 | $882 |

| Oil | $95 | $80 |

| Aluminum | $2,600 | $2,240 |

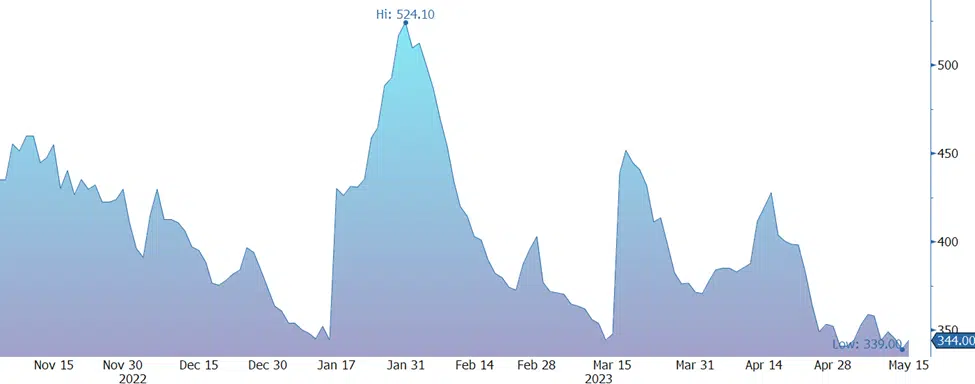

| Lumber | $500 | $344 |

| Wheat | $900 | $561 |

LB1 Lumber Commodity

LB1 Graph: Bloomberg

The current geopolitical situation is the most precarious it has been in thirty years. From the challenges in Afghanistan to the mishandling of the situation in Ukraine, as well as the volatile situation in the Middle East; all of these factors are disruptive to the global flow of goods and services. Despite the oil curtailment by Saudi Arabia, Russia, and Iran, oil continues to go lower, indicating that demand has fallen off a cliff.

Considering these economic indicators, our strategy is to stay positioned in the short end of the interest rate curve, which offers the best risk-return profile. However, we will be extending our duration in US treasuries to align with the impending economic slowdown. While Wall Street and Main Street may have reached a consensus that the Federal Reserve has ceased its rate hikes, we remain unconvinced that this is the situation. Our belief is that the Fed will implement one more interest rate increase in 2023, especially considering the number of strikes taking place across the United States, which is expected to drive wages higher.

*Morningstar Article

For Financial Professional Use Only – Email not for Public Distribution

Investing in any mutual fund involves risk, including loss of principal. There is no guarantee the funds will achieve their objectives. Expense ratios are as of the 9/28/2023 Prospectus.

An investor should consider the Fund’s objectives, risks, charges, and expenses carefully before investing or sending money. This and other important information can be found in each Fund’s prospectus. For more information, please call please read the prospectus carefully before investing.

Current Yield is the weighted average of the annual rate of return based on price. It is calculated by the coupon divided by the price. Average Yield-to-Maturity is the weighted average of the percentage rate of return if the security is held to maturity.

Leader Capital Corp. serves as adviser to Leader Short Term High Yield Bond Fund, and Leader High Quality Income Fund, distributed by Vigilant Distributions, Inc., Member FINRA/SIPC. Leader Capital and Vigilant are not affiliated.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Share prices and investment returns fluctuate and investor shares may be worth more or less than the original cost upon redemption. To obtain performance as of the most recent month-end, please call