2024 Market Outlook

John Lekas – CEO and Senior Portfolio Manager

February 20th, 2024

Inflation is expected to persist, as previously discussed in our newsletters. Our stance remains unchanged: the Federal Reserve is unlikely to lower interest rates until the unemployment rate (U-3) increases. The wildcard factor is the upcoming election year, and while there may be speculation that Powell could make concessions for Biden, I doubt it. Unemployment would need to rise for two consecutive quarters before the Fed would even consider lowering interest rates. In our opinion, CPI is of lesser relevance and will likely continue to persist higher. Prices will continue to rise across industries due to margin pressures, particularly stemming from increased labor costs.

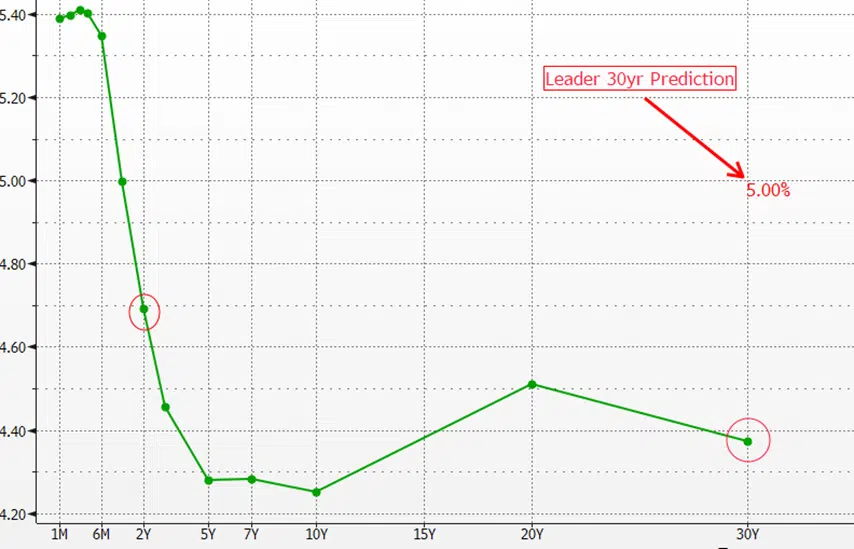

Given the strength of the economy, we anticipate the yield curve to reflect a strong economy resulting in a “normal” curve, where the long end is higher than the short end. Therefore, we expect normalization between the two-year and thirty-year yields. By year-end, we believe the thirty-year treasury will hit 5%, equity markets are projected to be higher due to inflationary pressures driving companies to raise prices. Volatility is expected to persist, with the VIX likely revisiting 35 on several occasions.

US Treasury Active Index Curve

Our fixed income strategies focus on managing risk/reward, which currently favors the short end of the yield curve, and extending duration when the opportunity arises. We are pleased to report that our mutual funds are currently leading in their respective spaces in 2024.

Time Period: 1/1/2024 – 2/20/2024

| Group/Investment | Return | Peer group percentile | Peer group rank |

| US Short-Term Bond | |||

| Leader Short Term High Yield Bond Ins | 6.17 | 1 | 1 |

| Leader Short Term High Yield Bond Inv | 6.18 | 1 | 1 |

| Benchmark 1: US Active Fund High Yield Bond | 0.20 | ||

| Benchmark 2: ICE BofA 1-3Y US Corp&Govt TR USD | 0.06 | ||

| Number of investments ranked | 632 | 632 | |

| US Intermediate-Term Bond | |||

| Leader Capital High Quality Income Instl | 1.37 | 1 | 1 |

| Leader Capital High Quality Income Inv | 1.23 | 1 | 1 |

| Benchmark 1: US Fund Intermediate Core-Plus Bond | -1.39 | ||

| Number of investments ranked | 582 | 582 |

*Source: Morningstar

For Financial Professional Use Only – Email not for Public Distribution

Investing in any mutual fund involves risk, including loss of principal. There is no guarantee the funds will achieve their objectives. Expense ratios are as of the 9/28/2023 Prospectus.

An investor should consider the Fund’s objectives, risks, charges, and expenses carefully before investing or sending money. This and other important information can be found in each Fund’s prospectus. For more information, please call please read the prospectus carefully before investing.

Current Yield is the weighted average of the annual rate of return based on price. It is calculated by the coupon divided by the price. Average Yield-to-Maturity is the weighted average of the percentage rate of return if the security is held to maturity.

Leader Capital Corp. serves as adviser to Leader Short Term High Yield Bond Fund, and Leader High Quality Income Fund, distributed by Vigilant Distributions, Inc., Member FINRA/SIPC. Leader Capital and Vigilant are not affiliated.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Share prices and investment returns fluctuate and investor shares may be worth more or less than the original cost upon redemption. To obtain performance as of the most recent month-end, please call