Will the Fed Lower This Year?

John Lekas – CEO and Senior Portfolio Manager

August 20th, 2024

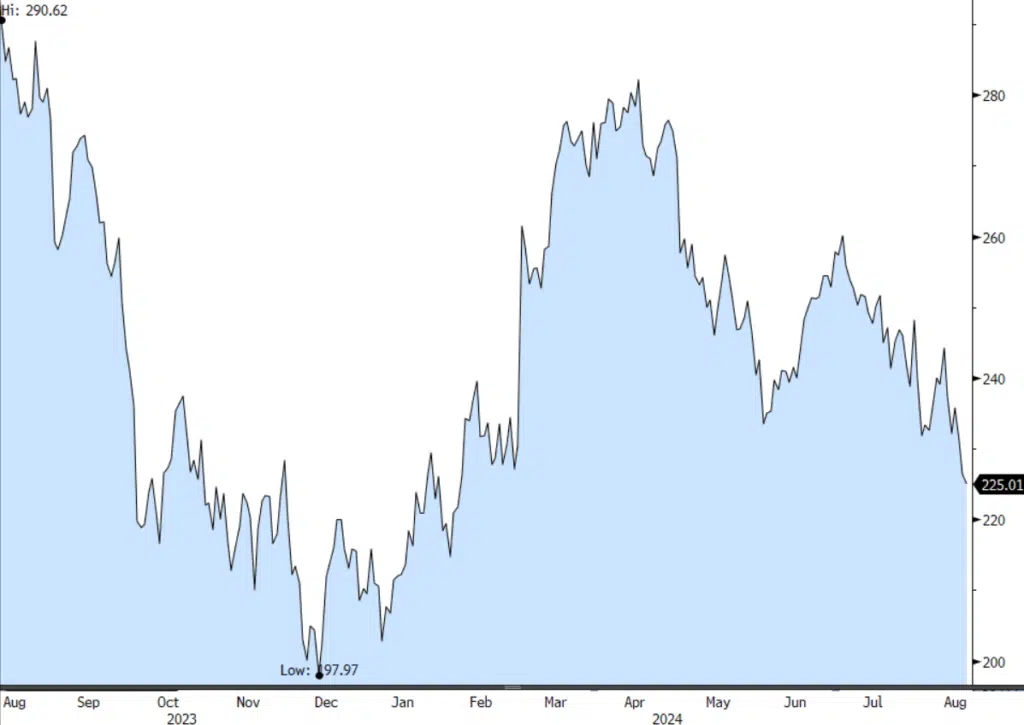

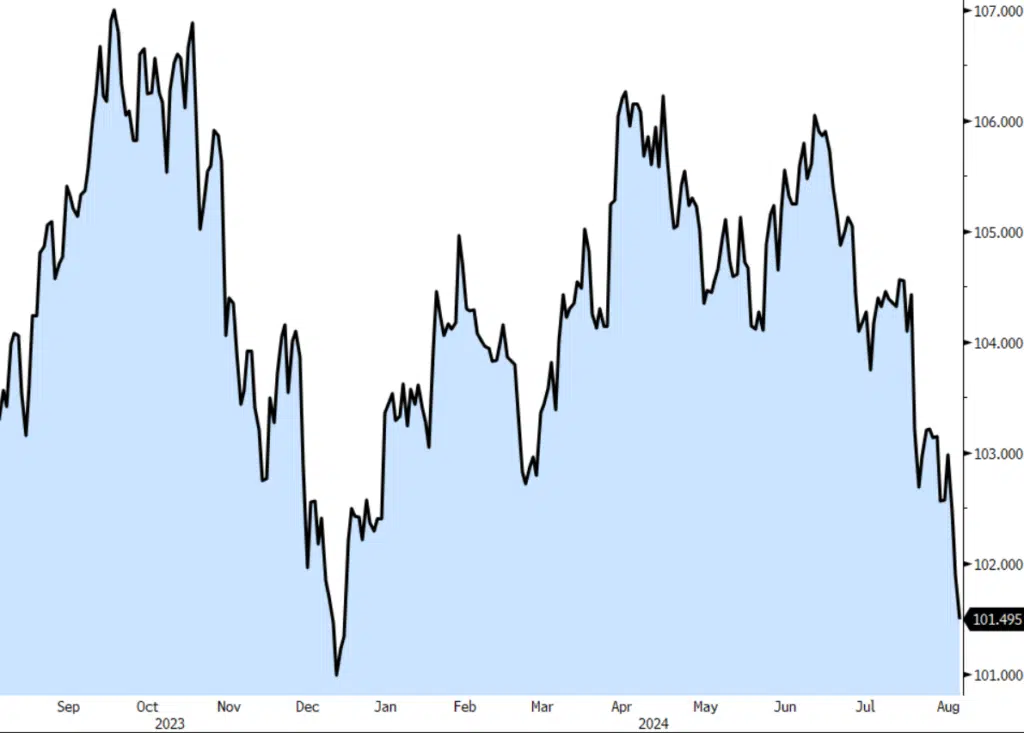

Currently, the United States’ debt-to-GDP ratio is approximately 143%, while China’s is approximately 297%. As the national debt for the U.S. and China reaches these levels, it becomes a race to the bottom for currencies because we cannot pay off our debt. The Federal Reserve would be lowering rates, however, it’s an election year, and the incumbents know that despite the deficit, cutting rates could drive the dollar into a free fall and, hence, gasoline to $7.00 a gallon, along with price increases for groceries and other commodities.

Therefore, we believe that the maximum rate cut this year will be 0.25%. Ultimately, the United States will move to a “polite default” and cut rates significantly (devalue our currency), not to stave off a recession, but to try and export our way to a more positive GDP and pay off debt with cheap dollars.

We believe lowering rates will trigger foreign buyers to sell treasuries as their investment is eroded by a falling dollar. Hence, long rates may rise. It is a conundrum, but when you have been this reckless with Fiscal Policy, this is the result, and there is no easy way out. The only way is through a weaker dollar, which will shift from wage to price inflation (meaning commodity prices will rise). In our view, we will not enter a recession in 2024 or 2025. Inflation and exports will drive the economy and equity markets higher

*Source: Bloomberg

For Financial Professional Use Only – Email not for Public Distribution

Investing in any mutual fund involves risk, including loss of principal. There is no guarantee the funds will achieve their objectives. Expense ratios are as of the 9/28/2023 Prospectus.

An investor should consider the Fund’s objectives, risks, charges, and expenses carefully before investing or sending money. This and other important information can be found in each Fund’s prospectus. For more information, please call please read the prospectus carefully before investing.

Current Yield is the weighted average of the annual rate of return based on price. It is calculated by the coupon divided by the price. Average Yield-to-Maturity is the weighted average of the percentage rate of return if the security is held to maturity.

Leader Capital Corp. serves as adviser to Leader Short Term High Yield Bond Fund, and Leader High Quality Income Fund, distributed by Vigilant Distributions, Inc., Member FINRA/SIPC. Leader Capital and Vigilant are not affiliated.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Share prices and investment returns fluctuate and investor shares may be worth more or less than the original cost upon redemption. To obtain performance as of the most recent month-end, please call