Trump Trade

John Lekas – CEO & Senior Portfolio Manager

November 18th, 2024

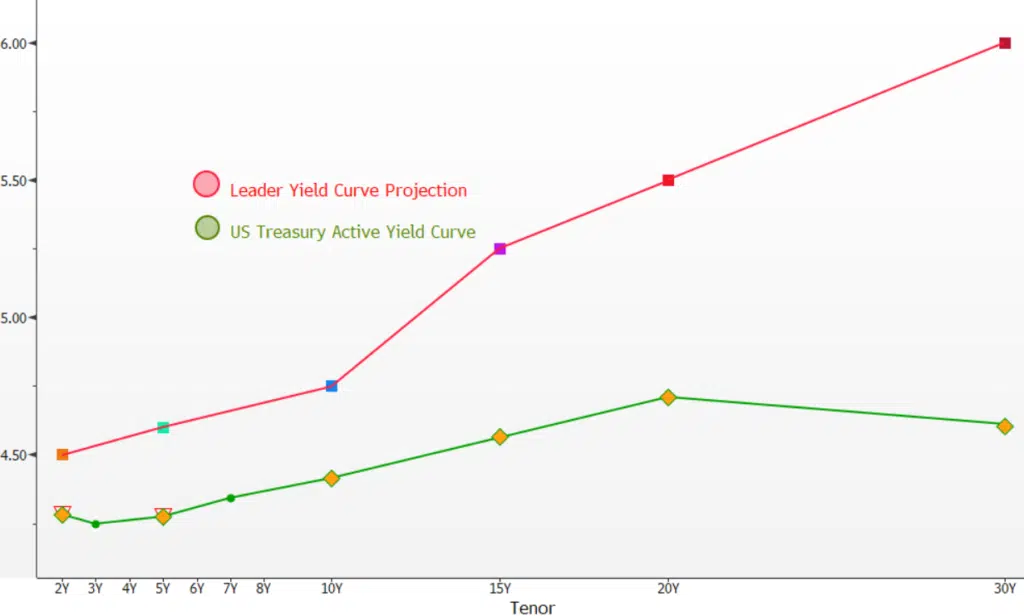

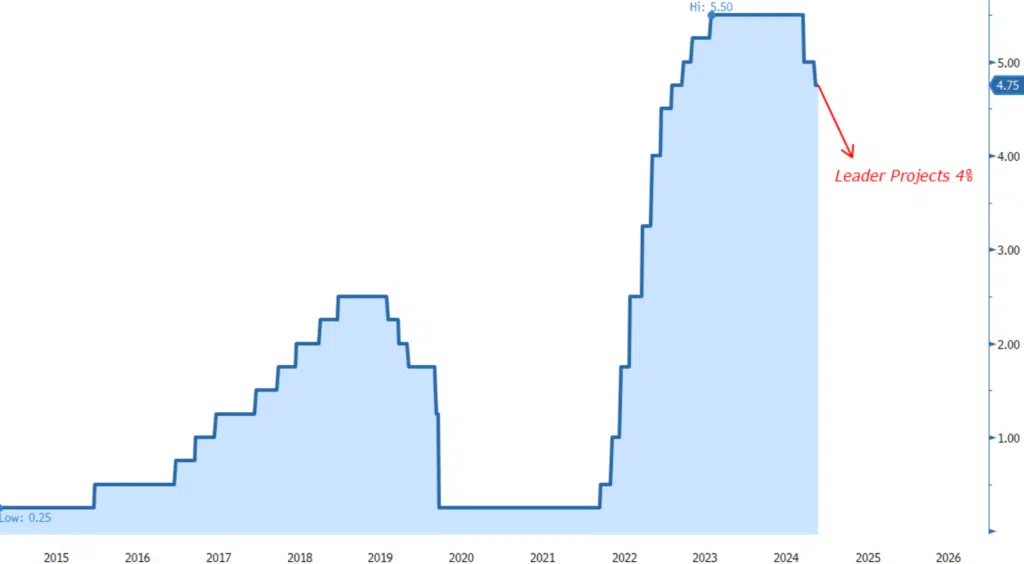

We continue to believe that a low-dollar policy is in place. With Trump in office, it is almost certain that fiscal and monetary policies will move in tandem. The issue of extending duration here is complex and may not be correlated to past Federal Reserve postures. We project that the fed funds rate will reach 4% by the end of 2025; however, we also anticipate significantly higher rates for the 10-, 20-, and 30-year Treasury bonds as inflation persists. The best risk/reward opportunities continue to be in the short end of the curve. There may be opportunities overseas as the dollar weakens, but this remains to be seen. Extending maturities over the past 18 months has proven to be a poor performer, and we expect this trend to persist.

The Federal Reserve has lowered rates despite 4% unemployment, credit spreads as tight as any period in the past 10 years, record-high equity markets, all-time high housing prices, and a post-COVID environment where corporations have locked in very favorable borrowing rates. We see this as a “dovish flop” driven by a data-dependent approach. The challenge with being “data-dependent” is the lack of flexibility, as numerous other factors influence inflation and employment. “Don’t fight the Fed”—unless the Fed is consistently looking through the rear view mirror, which, in our opinion, they are. Jerome Powell appears more focused on his legacy than on the broader economy at this point. Normally, the Federal Reserve lowers interest rates during a recessionary environment, causing long-term Treasury bonds to rally. However, the Fed is currently lowering rates in an inflationary environment, which is why the long end of the yield curve is selling off. This is the answer to the sixty-four-thousand-dollar question.

In summary, we foresee a weaker dollar and a normalized yield curve. We will consider extending duration when inflation shows signs of dissipating and yields that pay us for the risk of additional duration.

US Yield Curve Projection*

Federal Reserve Funds Rate*

*Source: Bloomberg. The views and statements expressed herein are those solely of Leader. This document contains preliminary information only, unless otherwise noted, and is subject to change at any time and is not and should not be assumed to be complete or to constitute all the information necessary to adequately make an investment decision. Investing in any mutual fund involves risk, including loss of principal. There is no guarantee the funds will achieve their objectives. Expense ratios are as of the 9/28/2023 Prospectus. An investor should consider the Fund’s objectives, risks, charges, and expenses carefully before investing or sending money. This and other important information can be found in each Fund’s prospectus. For more information, please call please read the prospectus carefully before investing. Current Yield is the weighted average of the annual rate of return based on price. It is calculated by the coupon divided by the price. Average Yield-to-Maturity is the weighted average of the percentage rate of return if the security is held to maturity. Leader Capital Corp. serves as adviser to Leader Short Term High Yield Bond Fund, and Leader High Quality Income Fund, distributed by Vigilant Distributions, Inc., Member FINRA/SIPC. Leader Capital and Vigilant are not affiliated. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Share prices and investment returns fluctuate and investor shares may be worth more or less than the original cost upon redemption. To obtain performance as of the most recent month-end, please call 1-800-269-8810