Eggs go higher

Slavik Kolesnik – Portfolio Manager

February 13, 2025

The latest data clearly challenges the prevailing narrative of Federal Reserve rate cuts and reinforces our view that interest rates will need to remain higher for longer. The recent CPI and PPI prints have significantly undermined expectations of a 100-basis-point rate cut from the Fed, highlighting the persistent inflationary pressures in the economy.

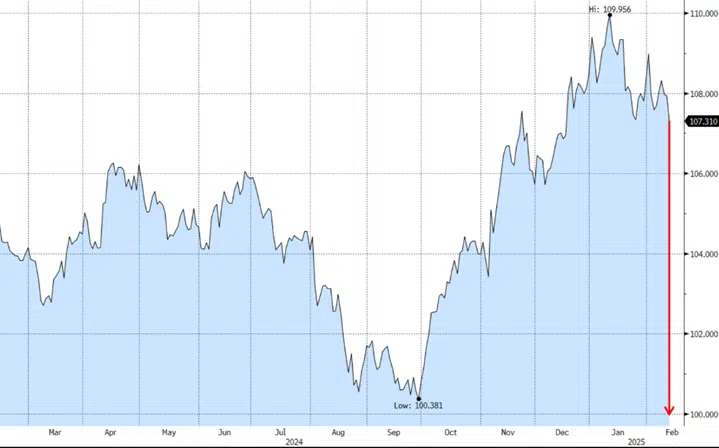

We anticipate the U.S. dollar retracing toward the 100 level, which carries important implications for price inflation. A weaker dollar increases the cost of imported goods and commodities, fueling price pressures across essential consumer basic goods, including food, where we could see egg prices and other grocery costs rise further. Higher inflation will squeeze demand for big-ticket consumer durables, such as housing, vehicles, electronics, and furniture. Elevated borrowing costs will further dampen affordability in the housing market, as mortgage rates remain high, reducing purchasing power and discouraging buyers from entering the market. This could slow home price growth or even lead to price declines in overheated regions.

At the same time, the 10-, 20-, and 30-year Treasury yields are expected to face continued pressure as inflation remains persistent, i.e., foreigners will demand higher returns as the dollar weakens, which is good for equities but unfavorable for duration and long-term US Treasuries. Until there are clear and sustained signs of cooling inflation, extending duration remains an unattractive risk/reward. We continue to maintain our position on the short end of the yield curve.

Leader US Dollar Prediction

*Source: Bloomberg. The views and statements expressed herein are those solely of Leader. This document contains preliminary information only, unless otherwise noted, and is subject to change at any time and is not and should not be assumed to be complete or to constitute all the information necessary to adequately make an investment decision. Investing in any mutual fund involves risk, including loss of principal. There is no guarantee the funds will achieve their objectives. Expense ratios are as of the 9/28/2023 Prospectus. An investor should consider the Fund’s objectives, risks, charges, and expenses carefully before investing or sending money. This and other important information can be found in each Fund’s prospectus. For more information, please call please read the prospectus carefully before investing. Current Yield is the weighted average of the annual rate of return based on price. It is calculated by the coupon divided by the price. Average Yield-to-Maturity is the weighted average of the percentage rate of return if the security is held to maturity. Leader Capital Corp. serves as adviser to Leader Short Term High Yield Bond Fund, and Leader High Quality Income Fund, distributed by Vigilant Distributions, Inc., Member FINRA/SIPC. Leader Capital and Vigilant are not affiliated. Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Share prices and investment returns fluctuate and investor shares may be worth more or less than the original cost upon redemption. To obtain performance as of the most recent month-end, please call