Nowhere to Hide

John Lekas - CEO & Senior Portfolio Manager November 13th, 2025 The traditional negative correlation between Treasuries and risk assets has broken down. Historically, when equities sold off, investors moved into Treasuries as a safe haven, creating a dependable inverse relationship. That dynamic has weakened considerably over the past five years and especially in the last year. As shown in…

Fed Cuts Once—More Political Than Economic

John Lekas – CEO and Senior Portfolio Manager September 18, 2025 On September 17, 2025, the Federal Reserve enacted its first—and likely only—rate cut of the year. Though the Fed has not indicated such motivation, our view that this move was politically motivated, rather than driven by compelling economic data Credit spreads remain tight, unemployment levels are stable (which is…

With the Fed Holding, the Dollar and Unemployment Tell the Real Story

John Lekas – CEO & Senior Portfolio Manager, Leader Capital August 5th, 2025 As expected by the team at Leader Capital, last week’s jobs report showed that the unemployment rate stayed put at 4.2%. Moreover, the Fed decided to hold rates steady. However, in our opinion, Powell’s decision not to cut does not paint a full picture of where the economy…

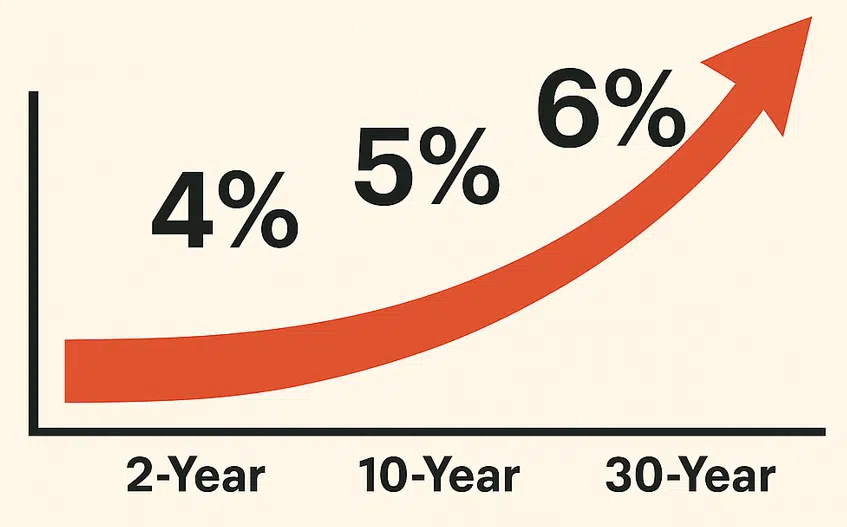

Treasury Yields Hit 4%, 5%, and 6%

John Lekas - CEO & Senior Portfolio Manager, Leader Capital May 12th, 2025 We believe U.S. Treasury yields are poised to rise meaningfully by year-end. Barring a major shift in global conditions, we see the 2-year reaching 4%, the 10-year nearing 5%, and the 30-year approaching 6%—up from current levels of 3.97%, 4.45%, and 4.87% (as of 5/12/25). This outlook…

“All’s Well That Ends Well”

John Lekas – CEO & Senior Portfolio Manager April 23, 2025 Credit markets and global interest rates remain relatively firm, reflecting a cautious but stable risk environment. We believe volatility will continue in equity and fixed income markets, but the fundamentals remain intact. Per the chart below, spreads have widened over the past month but are well within historic averages:…

Nowhere to Hide

John Lekas - CEO & Senior Portfolio Manager November 13th, 2025 The traditional negative correlation between Treasuries and risk assets has broken down. Historically, when equities sold off, investors moved…

Extending Duration?

John Lekas CEO & Senior Portfolio Manager December 20th, 2023 By extending the duration in our portfolio 100% at this juncture using 10-year treasuries (based on a target rate of…

Don’t Fight the Fed

John Lekas CEO September 22nd, 2023 "Don't fight the Fed.” These individuals are academics, not rational business people. The good news is they will inform you of their intentions; there's…

How Bond Funds Have Fared During the Fed’s Rate Hikes

When it came to helping investors navigate recent debt-market turmoil induced by Federal Reserve rate increases, bond-picking fund managers largely came up short. Of almost 2,000 actively managed bond funds…

Board of Directors / Andrew Rogers

Leader Capital recently held a vote by proxy to establish a stand alone trust. Meet our new Trustees, Andrew Rogers, Raymond Davis and Marty Kehoe, who will serve on our…

Leader Capital Celebrates 15-Year Anniversary of High Quality Income Fund

July 29th, 2025 Fund surpasses $1.2 billion in AUM and earns consistent 5-star Morningstar ratings…

Rate Cut or Rate Hike? Tariffs, Jobs & Inflation Leave Fed’s Path Uncertain

John doesn't see as deep of a rate cutting cycle and calls tariffs a "non-event."…

John Lekas: “The Fed is in no position to lower interest rates.”

Leader Capital President and Senior Portfolio Manager John Lekas joins Schwab Network’s Diane King Hall…

Lekas: Fed Won’t Cut This Year, Impact of ‘Low Dollar’ Policy

John Lekas discusses the biggest risks for fixed income investors in 2025, what metric he's…

Is Now A Good Time For Fixed-Income Investing? What Experts Are Saying

Leader Capital President, CEO, and Senior Portfolio Manager John Lekas shared his insights with Catherine…

Disclaimer: We are providing a link to the third party’s website solely as a convenience to you, because we believe that website may provide useful content. We do not control the content on the third-party website; we do not guarantee any claims made on it; nor do we endorse the website, its sponsor, or any of the content, policies, activities, products or services offered on the website or by any advertiser on the site. We disclaim any responsibility for the website’s performance or interaction with your computer, its security and privacy policies and practices, and any consequences that may result from visiting it. The link is not intended to create an offer to sell, or a solicitation of an offer to buy or hold, any securities.

The video presented is for informational purposes only and is not an offer to buy or sell a security or participate in any investment strategy. Information provided should not be used as substitute for individualized investment advice. Past performance does not guarantee investment results.